In the 2014 Budget, the UK Chancellor announced changes to pension rules meaning retirees are no longer forced to buy an annuity with the proceeds of defined contribution pension schemes.

Whilst the details and implications have still to be worked through, this simplification may well lead to wide ranging changes to the insurance, fund management and IFA sectors and possibly beyond, opening the door for innovators to reform a poor customer experience offering limited product choice.

What is the UK pension market?

The retirement finance market is an interesting one – a massive market that continues to grow, served by an outdated sector built around a single product (with limited variations) and offering a poor customer experience, whilst operating with high costs and low transparency, and addressing only a very narrow part of customers’ in-retirement needs.

Saving for retirement

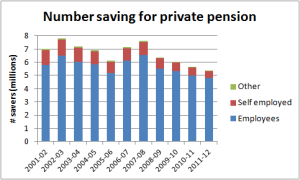

In 2012 there were over 5 million saving for a private pension, falling from around 7.5 million in 2008, most saving through occupational schemes. [Source: HMRC]

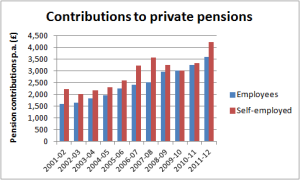

Contributions to private pensions have increased steadily over the last decade, doubling from around £2,000 p.a. in 2004 to around £4,000 p.a. in 2012. [Source: HMRC]

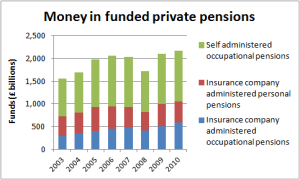

The funds held in private pension schemes have increased steadily to over £2 trillion in 2010 (with an understandable drop in 2008). Over the last decade there has been a trend away from defined benefit schemes to defined contribution schemes with almost 40% of occupational pension schemes in 2012 being defined contribution, up from around 25% in 2007. We estimate about half of private pension funds – £1 trillion – are affected by the recently announced changes. [Source: PPI]

Planning for retirement

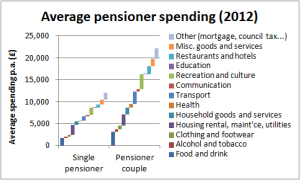

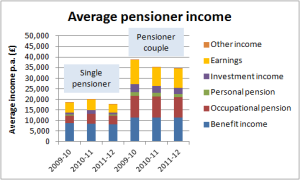

There are over 12 million people at pension age with over 8 million pensioner households and life expectancy at 65 is now around 25 years. Average spending each year for single pensioners is around £12,000 p.a. and for pensioner couples around £22,000 p.a., with most spending on food and drink, housing costs, transport, recreation and other costs (incl. council tax). [Source: ONS]

Typically income in retirement comes from multiple sources – state pension benefit, occupational pensions, personal pensions, investment income and earnings. On average a single pensioner has an income of around £18,000 p.a. and a pensioner couple of around £35,000 p.a. On average most income comes from state benefits, occupational pensions and earnings. [Source: DWP]

Converting pension pots into income

Traditionally, we have saved for retirement by making regular contributions to a pension scheme with the expectation that only one option broadly-speaking will be available on retirement – purchase of an annuity (with the possibility of taking up to a quarter as a tax free lump sum). And that it was ‘pot luck’ as to what retirement income we would get, depending on the annuity rates at the time we decide to retire. Worse still, most people have just accepted the annuity product offered by the firm they saved with for their pension.

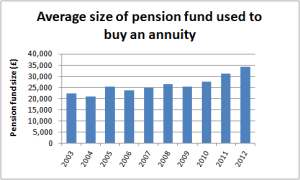

The average pension pot on retirement has grown in size from over £20,000 in 2004 to around £35,000 in 2012. [Source: ABI]

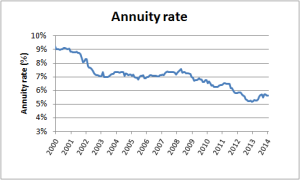

However, typical annuity rates have fallen significantly over the last decade from around 9% in 2001 to around 7% from 2003 to 2008, to around 5.5% in 2014. [Source: WilliamBurrows.com]

Growing pension pots combined with falling annuity rates have resulted in relatively flat average income of between £1,500 and £2,000 p.a. And over recent years there has been an inevitable drop in annuity sales from around 460,000 in 2009 to around 350,000 in 2013. [Source: ABI]

What’s changed?

As private pension schemes benefit from tax advantages, they are subject to rules relating to aspects such as annual and lifetime allowances, how the funds may be used on retirement, what lump sums may be taken and how they are taxed.

Some of these rules will stay in place, whilst others are changing.

Saving for retirement

Annual and lifetime limits have been reduced over recent years and it’s not certain if they’ll continue to fall or not. Some have suggested there may be advantages to unifying policies around pensions and other tax-efficient saving such as ISAs into a single approach. Indeed, the Treasury Committee appears to be enthusiastic about the idea as ‘a great prize’ which attracts ‘cross-party support’:

“[…] there may be scope in the long term for bringing the tax treatment of savings and pensions together to create a ‘single savings’ vehicle that can be used—with additions and withdrawals—throughout working life and retirement. This would be a great prize. The cross-party support for these savings and pensions announcements offers the prospect of a more stable and healthy environment for pension and savings taxation.”

Planning for retirement

Planning for retirement has three parts: firstly, guaranteed free advice or guidance to be offered to those on defined contribution schemes; secondly, further advice and support sought by people on retirement beyond the guaranteed free advice; and thirdly, ongoing support on financial decision through retirement years.

As part of the pension changes the Chancellor announced that the government would

“[…] introduce a new guarantee, enforced by law, that everyone who retires on these defined contribution schemes will be offered free, impartial, face-to-face advice on how to get the most from the choices they will now have.”

HMT outlines that the advice or guidance must follow standards developed by FCA and others:

“In order to ensure that this guidance really is impartial and high quality, providers and trust-based schemes will be required to ensure that the guidance follows a set of robust standards. […] The government will ask the FCA (working closely with the Pensions Regulator and the Department for Work and Pensions in relation to standards for trust-based pension schemes) to coordinate the development of these standards and the framework for monitoring compliance.”

The Treasury acknowledges that people may seek further advice – through regulated investment advice or an annuity brokerage service – or may invest their pension savings without advice (execution only), for example drawing on information sources and comparison sites.

“The government will work with the FCA to explore the extent to which regulated advice can be made more affordable through more cost effective delivery, such as through the development of online delivery channels.”

Taking advantage of the flexibility available to them, retirees will also want ongoing support with financial decisions through their retirement years, for example concerning care needs and inheritance planning.

The market for advice is large and constantly refreshed as more people approach and reach pension age. There are currently around 12 million individuals at or above state pension age with around 600,000 to 700,000 each year reaching state pension age at least to 2018. [Source: The Telegraph]

In-retirement income and drawings

Retirees have been required to buy an annuity using their funds accumulated in a pension scheme. Annuity rates have deteriorated in recent years leading to dissatisfaction with pension products. The market for pension and annuity products has been dominated by insurance companies.

The requirement to purchase an annuity with the proceeds of defined contribution schemes is to be removed.

The proposed reforms to pension rules mean at least two changes to the sector:

- The opening up of the market for fund management firms to offer saving and income products for retirement; and

- Increased demand before and following retirement for advisory services around financial decisions.

The greater flexibility over access to lump sums in retirement may also drive changes to nearby markets, for example the approach to long-term debt (e.g. mortgages for older borrowers) and covering ongoing care costs.

Where’s the opportunity?

Saving for retirement

A clear opportunity is product innovation targeting the market for long-term savings products that are not tied to conversion to annuity products – opening up competition to insurance companies from fund managers.

As pressures for integrating pension and other tax-efficient savings schemes under a unified approach increases the move to whole-life savings and investments products will open new opportunities for product innovators and IFAs. For example, demand for whole life planning whilst saving may become more prevalent.

Planning for retirement

The advice or guidance guaranteed by the Chancellor in Budget 2014 is likely to become an obligation on those providing defined contribution schemes.

Two types of opportunity may arise here: firstly, for additional and ongoing support and advice on financial decisions (likely to be regulated by the FCA); and secondly, for tools and information used either directly by consumers or by those providing financial support and advice.

With the new flexibility in how funds can be used a more comprehensive approach to investment decisions may emerge addressing, for example lifestyle ambitions, their cash flow implications, selection of product types to generate the desired cash flows, choice of specific products, execution of those choices, and anticipating unlikely events.

In retirement

A key area for innovation is improved transparency and efficiency in the annuity market (for many an annuity will remain the best choice of in-retirement product) promoting greater competition and better value for customers.

Product innovation may flourish in new types of in-retirement product that allow flexibility between taking an income and drawing lump sums and for example allowing top-ups to annuity funds (say, from home equity release or inheritances) to increase income.

Approaches may emerge that consider accumulated wealth across equity in homes, pension funds and other investments and help retirees make trade-offs between, for example, equity release and drawing on pension pots.

Beyond meeting immediate lifestyle needs in retirement, demand may grow for products and services offering some protection against or planning for care costs, inheritance, supporting family members with lump sum, etc.

Conclusion

Whilst the details and implications have still to be worked through, the simplification in pension rules could lead to wide ranging changes for the insurance, fund management and IFA sectors and possibly beyond.

The challenge is to ensure innovation isn’t stifled by new regulatory requirements and that government intervention to ‘help’ new approaches (such as for guaranteed advice or guidance) doesn’t displace entrepreneurial activity.

In particular, there is an attractive opportunity for tech-enabled innovators to reform a rather poor customer experience offering limited product choice. With a cost-laden and opaque business model, the established ‘retirement finance’ industry is ripe for radical change.

To explore opportunities in the Retirement Finance market further, contact The Venturing Firm for an initial meeting.

Sources

HMT, Budget Speech, March2014: https://www.gov.uk/government/speeches/chancellor-george-osbornes-budget-2014-speech

HMT, Freedom and Choice in Pensions, March 2014: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/294795/freedom_and_choice_in_pensions_web_210314.pdf

HMT, Pensions: ending the requirement to annuitise, March 2014: www.parliament.uk/briefing-papers/sn00712.pdf

Treasury Committee, Report on 2014 Budget, May 2014: http://www.parliament.uk/business/committees/committees-a-z/commons-select/treasury-committee/news/budget2014report/

HMRC, Personal Pensions Statistics, February 2014: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/285063/pensions-intro.pdf

PPI, Pension Facts, November 2013: http://www.pensionspolicyinstitute.org.uk/pension-facts/pension-facts-tables

DWP, The Pensioners’ Incomes Series, July 2013: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/211685/pi-series-1112.pdf

ONS, Family Spending, December 2013: http://www.ons.gov.uk/ons/rel/family-spending/family-spending/2013-edition/index.html

ONS, Household Pension Resources, October 2012: http://www.ons.gov.uk/ons/dcp171766_281063.pdf

William Burrows, Annuity Line Chart: http://www.williamburrows.com/charts/annuity10k.aspx

ABI, The Annuity Market Facts and Figures, February 2014: https://www.abi.org.uk/~/media/Files/Documents/Publications/Public/2014/Pensions/The%20UK%20Annuity%20market%20Facts%20and%20Figures.ashx

ABI, Long-term insurance statistics update, 2012: https://www.abi.org.uk/News/Industry-data-updates/2013/08/Long-term-insurance-statistics-update

FT Advisor, interview with Paul Smee of Council of Mortgage Lenders, May 2014: http://www.ftadviser.com/2014/05/07/ifa-industry/tax-planning/pension-changes-will-ripple-through-industry-cml-ivDQnWkSUB7vryAQEbVbSN/article.html

The Telegraph, “Record numbers reach retirement age as baby boomers turn 65”, September 2012: http://www.telegraph.co.uk/finance/personalfinance/pensions/9563647/Record-numbers-reach-retirement-age-as-baby-boomers-turn-65.html